| Uploader: | Sakura240 |

| Date Added: | 17.05.2015 |

| File Size: | 70.43 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 27191 |

| Price: | Free* [*Free Regsitration Required] |

South Western Federal Taxation Individual Income Taxes | Download

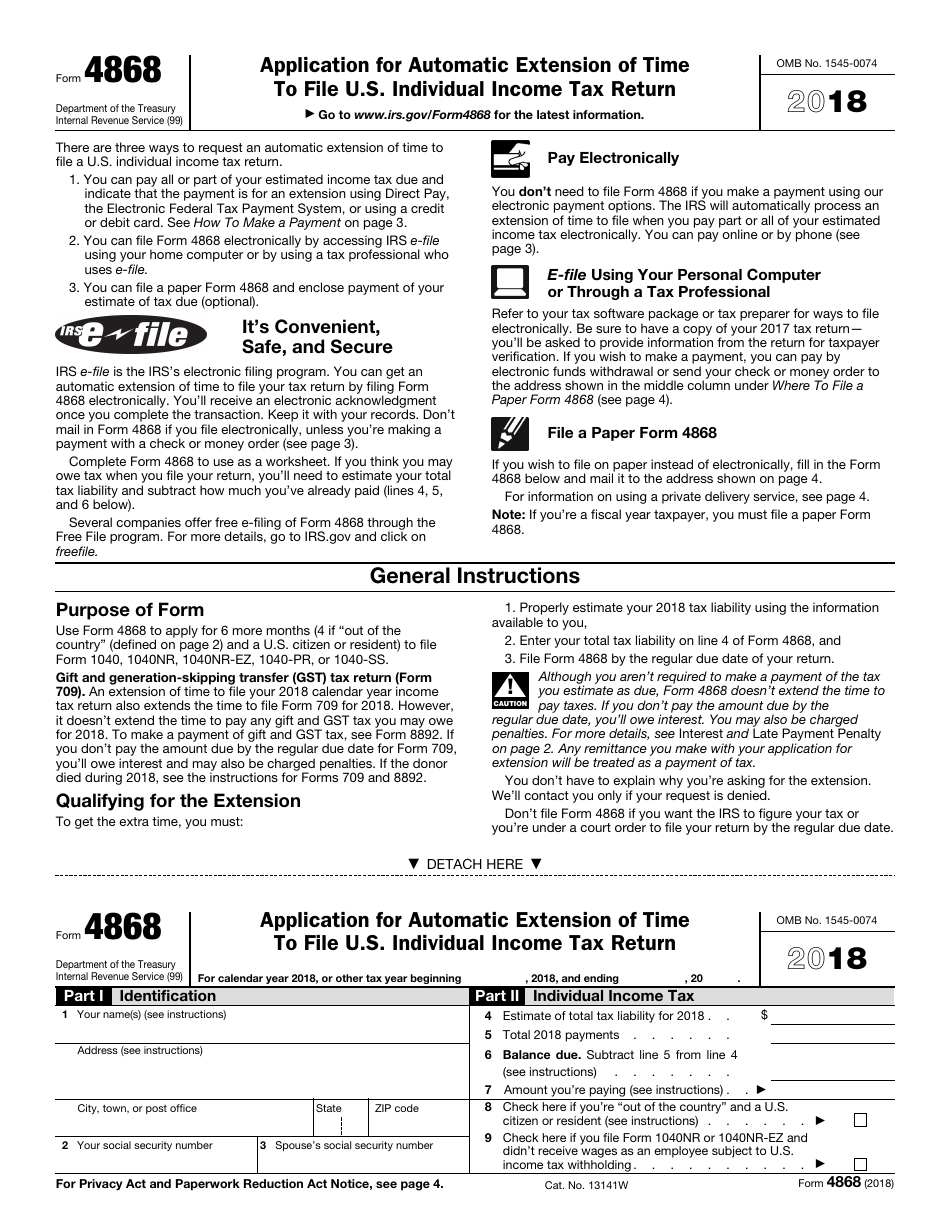

Master today's tax concepts and current tax law with SOUTH-WESTERN FEDERAL TAXATION INDIVIDUAL INCOME TAXES, 45E and accompanying professional tax software. Updates emphasize the most recent tax changes and developments impacting individuals with coverage of the Tax Cuts and Jobs Act of and related guidance from the treasury South-western Federal Taxation Individual Income Taxes Hoffman, William H, Young, James C, Raabe, William A, Maloney, David M 0 / 0 Dec 23, · South-western Federal Taxation Individual Income Taxes 41st Edition by William H. Hoffman English | | ISBN: X, | Pages | PDF | 33 MB

South-western federal taxation 2018: individual income taxes pdf download

South Western Federal Taxation Individual Income Taxes Author : James C. This reader-friendly presentation emphasizes the latest tax law affecting individual taxpayers, south-western federal taxation 2018: individual income taxes pdf download, including the most recent tax changes and reforms.

Complete coverage of the Tax Cuts and Jobs Act of offers related guidance from the Treasury Department. This book's distinctive Framework demonstrates both how topics relate to one another and to the Form Clear examples, frequent summaries and memorable tax scenarios further clarify concepts and help you south-western federal taxation 2018: individual income taxes pdf download critical-thinking, writing and research skills. Learn how taxes impact you personally with the most thorough coverage of individual income taxation today.

You can even use this edition to prepare for the C. exam or Enrolled Agent exam or to begin study for a career in tax accounting, financial reporting or auditing.

Important Notice: Media content referenced within the product description or the product text may not be available in the ebook version. West s Federal Taxation Author : Publisher : Release Date : Genre: Income tax Pages : ISBN 10 : UCLA:L GET BOOK West s Federal Taxation Book Description :. South Western Federal Taxation Author : James C. This reader-friendly presentation provides the most effective solution to help you master individual taxation.

You examine the most current tax legislation for individual taxpayers at the time of publication. Clear examples, more summaries and meaningful tax scenarios clarify concepts and sharpen your critical-thinking, writing and research skills. The book's framework effectively demonstrates how topics relate to one another and to the form. Each new book includes instant access to Intuit® ProConnect tax software, Checkpoint® Student Edition from Thomson Reuters, and CengageNOWv2 optional online homework solution.

Trust this edition for the most thorough coverage of individual income taxation available today, including the Tax Cuts and Jobs Act of Updates emphasize the most recent tax changes and developments impacting individuals.

You examine coverage of the Tax Cuts and Jobs Act of with related guidance from the treasury department. A distinctive Framework demonstrates how topics relate to one another and to Form Recent examples, updated summaries and current tax scenarios clarify concepts and help you sharpen critical-thinking, writing and research skills. In addition, sample questions from Becker C. Review help you study for professional exams. Equipped with a thorough understanding of today's taxes, south-western federal taxation 2018: individual income taxes pdf download, you can pursue the tax portions of the C.

or the Enrolled Agent exam with confidence or apply your knowledge to a career in tax accounting, financial reporting or auditing. South Western Federal Taxation Individual Income Taxes Author : William H. South-western federal taxation 2018: individual income taxes pdf download for its understandable, time-tested presentation, this book remains the most effective solution for helping readers thoroughly grasp individual taxation concepts.

This edition reflects the latest tax legislation for individual taxpayers at the time of publication. The authors build on the book's proven learning features with clear examples, summaries and meaningful tax scenarios that help clarify concepts and sharpen readers' critical-thinking, writing, and research skills.

The book's framework clearly demonstrates how topics relate to one another and to the form. South Western Federal Taxation Individual Income Taxes Book Only Author : William H.

An edited version of the first two WFT textbooks, this book offers a thorough and balanced treatment of relevant tax Code and regulations as applied to individuals and corporations.

Ideal for undergraduate or graduate levels, this text works for either a one-semester course in which an instructor wants to integrate coverage of individual and corporate taxation, or for a two-semester sequence in which the use of only one book is desired. West Federal Taxation Author : James E. You master key taxation concepts and applications for success in accounting and taxation.

You can also use this resource to prepare for the C. or Enrolled Agent Exam. This edition examines the most current tax law, from recent tax law changes to complete coverage of the Tax Cuts and Jobs Act of with related guidance from the Treasury Department.

Concise coverage highlights the most important rules and concepts on income, deductions and losses, property transactions, business entities, multi-jurisdictional taxation, as well as taxes on financial statements. Clear examples, summaries and tax scenarios further clarify concepts and sharpen critical-thinking, writing and research skills.

Each new book includes south-western federal taxation 2018: individual income taxes pdf download access to Intuit® ProConnect tax software, Checkpoint® Student Edition from Thomson Reuters, south-western federal taxation 2018: individual income taxes pdf download, CengageNOWv2 online homework solution and MindTap Reader.

Renowned for its understandable, time-tested presentation, this book remains the most effective solution for helping students thoroughly grasp individual taxation concepts. This book reflects the latest tax legislation for individual taxpayers at the time of publication, while continuous online updates keep your course current with additional tax law changes as they take effect. Proven learning features, such as Big Picture examples and tax scenarios, help clarify concepts and provide opportunities to sharpen students' critical-thinking, writing skills, and online research skills.

The chapter-opening feature Framework Tax Formula for Individuals shows how topics relate to the form. CONSER Editing Guide Author : Publisher : Release Date : Genre: Cataloging of serial publications Pages : ISBN 10 : IND GET BOOK CONSER Editing Guide Book Description :.

Study Guide to Accompany West s Federal Taxation Individual Income Taxes Edition Author : Gerald E. Whittenburg Publisher : Release Date : Genre: Income tax Pages : ISBN 10 : GET BOOK Study Guide to Accompany West s Federal Taxation Individual Income Taxes Edition Book Description :. West s Federal Taxation Author : William H. Hoffman Publisher : Release Date : Genre: Income tax Pages : ISBN 10 : GET BOOK West s Federal Taxation Book Description :.

West Federal Taxation Author : William H. Hoffman, Jr. Publisher : South-Western Pub Release Date : Genre: Income tax Pages : ISBN 10 : X GET BOOK West Federal Taxation Book Description : West Federal Taxation: Individual Income Taxes continues to set the standard in introductory tax.

With its thorough, accessible coverage, no other text helps users better master the ever-changing Individual Tax Code. This text provides comprehensive and authoritative coverage of the relevant codes and regulations as they pertain to the individual taxpayer, as well as coverage of all major developments in federal taxation.

Covering all major developments in federal taxation, there is no other text as effective at helping users master the ever-changing Individual Tax Code. Popular Books. My Lovely Wife by Samantha Downing. The Last Thing He Told Me by Laura Dave. The Maidens by Alex Michaelides.

Federal Tax 1, Ch 1 Intro to Taxation and the Federal Income Tax

, time: 11:24South-western federal taxation 2018: individual income taxes pdf download

Master today's tax concepts and current tax law with SOUTH-WESTERN FEDERAL TAXATION INDIVIDUAL INCOME TAXES, 45E and accompanying professional tax software. Updates emphasize the most recent tax changes and developments impacting individuals with coverage of the Tax Cuts and Jobs Act of and related guidance from the treasury South-western Federal Taxation Individual Income Taxes Hoffman, William H, Young, James C, Raabe, William A, Maloney, David M 0 / 0 Dec 23, · South-western Federal Taxation Individual Income Taxes 41st Edition by William H. Hoffman English | | ISBN: X, | Pages | PDF | 33 MB

No comments:

Post a Comment